Is Courier Parcel Service A Natural Monopoly Or Oligopoly?

Among the many secular macroeconomic trends over the past 2 decades, two of the about important have been a consequent ascent in international trade and a growing shift towards E-Commerce. Consider some brief statistics.

Prior to the ratification of NAFTA, in the twelvemonth 1990, the United States total trade with the world (imports plus exports) was almost $1.15 trillion or about xix.8% of the so $5.80 trillion GDP. The 2009 comparable figures were $3.52 trillion and $fourteen.43 trillion. Nominal Gdp rose at a 4.66% rate over this time flow while total trade rose at a 5.74% rate, pushing its share of the economy to 24.37%. Trade has likewise increased throughout the balance of the globe, driven by many factors including low toll country sourcing. Globalization has fundamentally contradistinct how supply bondage are viewed and managed, causing the complexity inherent in sourcing, purchasing, and distribution to rise substantially.

A second trend that has become rather pronounced in the last decade has been the growth of consumer purchases over the cyberspace. In the year 2000, Amazon.com posted revenues of $ii.76 billion and Ebay'due south (EBAY) revenue amounted to $431 million according to company SEC filings. Compare that to revenue figures for the year 2009: Amazon.com'due south (AMZN) revenue was $24.51 billion and Ebay'due south revenue was $eight.73 billion. That means that for the previous decade revenue compounded at a combined 26.41% for both of these companies. Of class, neither Amazon nor Ebay (or for that matter any E-Commerce retailer) could be without some means of fulfilling orders.

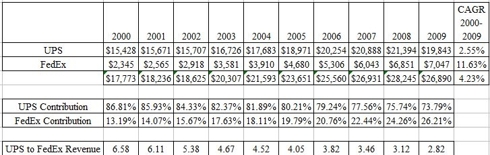

Both globalization and changing consumer purchasing patterns have been welcome shifts to modest bundle transportation providers, an industry in the United states that consists of just two companies: UPS (NYSE:UPS) and FedEx (NYSE:FDX). How is it that the overnight and footing small packet shipping markets have get so concentrated in just 2 companies? What are the similarities and differences between the business models of UPS and FedEx? What are the financial prospects for transportation providers and how well is that currently reflected in stock prices? Information technology is to these questions that nosotros now turn our attention.

The Oligopoly: How We Got Hither

UPS

UPS traces its origins to the American Messenger Company which was founded in Seattle in 1907 by Jim Casey and Claude Ryan. At the time, messengers had a poor reputation, oftentimes identified with saloons and brothels. Casey and Ryan hoped that an opportunity existed for a messenger visitor that was undecayed and hired courteous and clean cut employees. The company grew past focusing on deliveries between retail stores and its customers, a niche larger delivery companies ignored at the time. It was in 1919 that the visitor renamed itself United Bundle Service. Information technology also duplicated the Seattle concern in other cities: Oakland, Los Angeles, San Francisco, Portland, San Diego, and Santa Barbara. Each of these businesses were essentially contained of each other, in other words the business was not designed to ship packages betwixt Portland and Los Angeles, it was designed to transport goods within each of these cities. What the business did offer was a consequent arroyo and policies, a united arroyo to running operations that were split – thus, United Packet Service. Amongst the policies was a near obsession with advent. This was necessary in lodge to convince department stores to allow the visitor to represent them in making deliveries to their customers. The famous chocolate-brown that became synonymous with the visitor was chosen because information technology was easiest to keep clean.

UPS continued its measured growth, successfully adding one urban center at a time. Amid the milestones was the beginning of a New York City performance in 1930. The business organisation model that was created, however, started to slowly lose relevance with the adoption of automobiles and suburban shopping malls following the 2nd World War. UPS' successful model started to broaden every bit a result, since it was already visiting department stores to pick up packages it became natural to begin delivering shipments from the department stores suppliers at the aforementioned time. Unlike customers, suppliers are non necessarily located in the same city as the department stores were. Over time, this led to an integration of the operations. By the late 1970s UPS' domestic basis operations had get fully integrated. Although improvements accept been made the current network continues to be managed in a similar way.

International expansion began in 1975 with operations in Toronto. The post-obit year, operations were started in West Frg. Later initial struggles in Westward Deutschland, the visitor altered course and decided to expand through conquering rather than building networks completely from scratch. Over time, these acquisitions were linked together so that the European network resembled the ane set up in the Us. Cologne, Germany was chosen as the central hub. The breakthrough into Asia came in 1988 with the purchase of Hong Kong based Asian Courier Systems (ACS) which had operations in Malaysia, Hong Kong, Singapore, Taiwan, and Thailand.

In response to the biggest threat UPS has faced, airplanes were purchased in 1981 and "Next Twenty-four hours Air" service was launched through the performance of four contained airlines. These operations were consolidated in 1988 through the germination of UPS Airlines. The volume from air and ground operations was consolidated for small package delivery to customers. This means that a UPS driver delivers both limited and basis shipments inside his route rather than employing split up drivers for each class of volume. The central Us hub of operations is currently located in Louisville, KY much as Cologne, Frg is the fundamental hub of European operations. The integrated air and ground network established in the United States was mirrored in Europe when air operations were started there.

In recent years the visitor has aggressively expanded across package delivery by making a slew of acquisitions in the areas of logistics and freight. Expanding in this way meant both diversification from bundle delivery and at the same time owning assets that could spur modest parcel volumes. Among the largest acquisition was Fritz Companies for $437 million in 2001. Its primary business was freight forwarding, which is a company that does not own transportation avails, merely rather purchases transportation space in majority for carriers and so arranges for the best way of transportation for its individual customers. Other acquisitions included customs brokerages, which coordinate the menses of information between suppliers, carriers, and community agents in order to ensure a smoothen immigration process. Amongst the largest of these were Trans-Border Customs Service and Edge Brokerage Visitor. Asset based heavy air freight capabilities were added in 2004 with the purchase of Menlo Worldwide Forwarding from Con-Way for $150 million in greenbacks and $110 million in debt. The air freight business operations have later on been merged into the overnight small bundle operations. Less-than-Truckload freight capabilities were added in 2005 with the purchase of Overnite Transportation (now UPS Freight) for $1.225 billion. Get-go International Bancorp was acquired in 2001 for $78 1000000 in order to facilitate structured merchandise finance (it is now UPS Capital). Finally, it was also in 2001 that Postal service Boxes, etc. (now The UPS Store) was purchased for $185 million in social club to deepen relationships with pocket-size businesses.

For the year 2009, 62% of revenue was generated by US domestic package operations, 21% by international package operations, and 17% by supply chain and freight operations.

FedEx

Frederick Smith was born in Marks, Mississippi but a couple of months after Centrolineal troops landed at Normandy Beach in France. The newspaper Smith wrote at Yale about overnight delivery service has achieved near mythical condition, simply it was Smith'south time in the Marine Corps that was nearly influential in the development of the ideas that launched Federal Express, equally Smith noted the inefficiencies of the system and reflected on ways it could exist improved. Smith's father was a successful businessman (owning a eating house concatenation and a bus company that was sold to Greyhound). Smith used the $4 million his father left him to start Federal Express, forth with venture uppercase.

Smith's philosophy hinged upon a few ingenious insights. First, a huge market exists for overnight delivery for disquisitional, time sensitive shipments. Second, the current industry approach of moving air packages through rider flights could never exist successful since it was hard to reach economies of calibration and on fourth dimension performance could non be controlled. Third, rather than flying betoken to point, the most efficient construction was a hub and spoke network but equally ground networks were organized. These ideas guided Federal Express, which commenced operations in April, 1973.

The yr 1977 was an important one, one that helped establish Federal Express as a solid franchise. Get-go, a strike at UPS helped short term volumes. Secondly, and far more importantly, the aviation manufacture was de-regulated (the act was signed by Jimmy Carter the post-obit year). The lifting of regulations allowed for a great deal of flexibility in terms of how flight schedules were constructed and the types of equipment that could be purchased. By 1983, the company surpassed $1 billion in revenue. In terms of offset ups, Federal Express ranks as 1 of the almost successful in history.

In society to proceeds access to international markets acquisitions were made. The showtime of notation was the purchase of Gelco Express International, a Minneapolis company with service to dozens of foreign markets. The purchase of Tiger International for $895 million at the end of 1988 was the most important, not only did it cement Federal Limited'due south leadership in the express market but brought with it a leadership role in Asian markets.

The path from an international express visitor towards one offer a portfolio of transportation products came about through a single purchase: Quotient Systems, Inc. When Federal Express and Caliber merged a new entity was created called FedEx Corp. The company endemic assets in four areas: ground transportation (through RPS, which is now FedEx Ground); Less-Than-Truckload Freight (through Viking Freight which is now FedEx Freight W); expedited freight (through Roberts Express at present FedEx Custom Critical); and freight forwarding and logistics. The company was the creation of one of the largest unionized LTL carriers – Roadway Express.

Roadway had a long history of prosperity and success navigating the regulated trucking mural. Shortly after airlines were de-regulated, trucking was besides. Carriers that had enjoyed decades of above average profitability found it hard to adjust to the increased competition that came with de-regulated markets. Roadway was no exception. In facing up to new realities, the company altered strategic class and created a holding visitor called Roadway Services Inc. The national LTL carrier Roadway Express was initially the only subsidiary. Afterwards surveying the post de-regulation landscape, the outset buy was made in 1984 of Spartan Limited. The national LTL business is based upon a hub and spoke model, a very efficient model for transporting goods over big distances; but i not very efficient for handling goods over shorter distances where signal to point handling of freight minimizes both cost and transit fourth dimension. (This difference is very like to the differences in approach that Southwest Airlines took as compared with national airlines such as American and United.) A 2nd conquering, Nationwide Carriers, a specialized carrier in areas such as temperature controlled shipping and flatbed equipment; the final buy fabricated in 1984 was of a visitor called Roberts Express from Emery Air Freight, Roberts specialized in making same solar day deliveries by truck rather than air when it was economically justifiable to do so.

The nearly aggressive projection that Roadway Services committed itself to was Roadway Package Service (RPS) in 1985. The plan was to compete with United Parcel Service by having a lower price structure through the extensive use of technology and independent contractors. Afterward the required first up catamenia of losses and investments the visitor was a huge success.

I of the longest and most impactful strikes in the LTL industry began in April, 1994. The largest LTL carriers had proposed a contract that would have continued to deport in a higher place boilerplate wages for union members only as well greater flexibility for corporations including office time workers during peak periods and the ability to use rail more extensively in moving freight. The union turned down the concessions and walked out on the morn of Apr 6, 1994. The crippling strike lasted 24 days. In response, Roadway Services Inc. decided to divide the company into two pieces in August, 1995 – ane piece was the unionized long booty carrier Roadway Express and the other piece was the collection of assets that had been assembled since de-regulation, this piece was called Caliber Systems Inc. Although losses would close downward both Spartan Express and Nationwide Carrier, RPS, Viking, and Roberts formed a solid core.

August, 1997 brought some other strike, this one at UPS – it lasted xv days. Prior to the start of the strike Federal Express and Caliber had already started discussing a merger. The strike caused the volume at both companies to increment by xv%, a portion of which stuck following the strike. The bargain closed in January, 1998.

The next large acquisition was announced in November, 2000 (and was closed the post-obit year) for regional LTL carrier American Freightways for $1.2 billion. In time Viking became FedEx Freight Due west and American Freightways became FedEx Freight East. National LTL capability was added with the purchase of Watkins Motor Lines for $780 million in 2006, the company is at present FedEx National LTL.

The 2 remaining acquisitions of note were for the Kinko's concatenation in 2004 (now FedEx Office) for $2.four billion and for Parcel Direct also in 2004 (now FedEx SmartPost) for $120 million.

For the fiscal year ended in May, domestic limited was 33.vii% of revenue, international limited was 27.8%, ground was 21.2%, freight was 12.3%, and services was 5.one%.

Philosophical and Strategic Differences

UPS and FedEx conspicuously adult from distinct forces. In many ways UPS has historically operated equally a partnership with the company'southward managers beingness the partners. The company did not participate in an IPO until 1999, earlier that time the visitor was endemic by current and old employees. UPS expanded methodically and consistently over decades, slowly calculation operations in 1 place afterward another. It never made any major acquisitions until the most recent decade in order to build the supply chain and freight segment. The company has been unionized since around 1920 and UPS does not seem to view unions as a liability other companies would. In fact later the acquisition of Overnite, trivial was washed to block the unionization of parts of the company. Finally, since UPS grew then methodically, it seeks to integrate operations every bit much as possible. As examples: both air and ground pickup and delivery operations are merged and afterwards purchasing Menlo Worldwide Forwarding the operations were merged with the overnight business organisation.

FedEx has been built through the prescience and entrepreneurship of a single person, Frederick Smith and through the entrepreneurial spirit of Roadway Services. Whereas UPS has become comfortable with its union workforce (it admittedly took a long fourth dimension), FedEx has a greatly anti-union culture and its basis drivers continue to exist contained contractors. Because of this, unlike UPS, FedEx does not typically operationally integrate its acquisitions. They have expressed their strategy every bit: "operate independently…compete collaboratively".

Marketplace Positions

It is difficult to get accurate market share numbers for all regions of the globe. The largest reason for this is that although UPS and FedEx study revenue for all of their various segments and betwixt the United states and the rest of the world, information technology does not break out its international revenues by land or fifty-fifty by region.

Internationally, the small parcel market is no duopoly as it is in the U.s.. Many strange markets are dominated by current and old postal services. For instance, Purolator is the largest Canadian small parcel firm (it is 90% endemic by Canada Post), while Europe's largest participants include entities owned by postal services whose mail service monopoly has ended. This includes Germany (DHL), kingdom of the netherlands (TNT), France (La Poste), and the United Kingdom (Majestic Post).

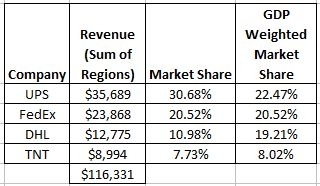

Globally, four firms, UPS, FedEx, DHL, and TNT, dominate with a combined market share of around seventy%. DHL and TNT accept no direct United States presence, but in nearly other regions DHL has a larger presence than either UPS or FedEx.

The market share figures presented below are very skillful estimates, merely they are by no means perfect. Several sources were used to cull together the data, generally Annual Reports and SEC filings of all four large players merely too from information compiled past the business firm SJ Consulting. The almanac reports of DHL and TNT are far more valuable in presenting market information than either those of UPS and FedEx. Not all sources of acquirement are covered, for example about eighty% of UPS' international revenue appears in the market figures and 20% does not. This is likely due to certain regions of the world being unaccounted for and an emphasis on export rather than domestic revenues.

Domestic revenue is divided between ground and express, European revenue is divided between intra-Europe and export, and all other figures are solely for export revenues.

Figures for the LTL and logistics markets are from SJ Consulting.

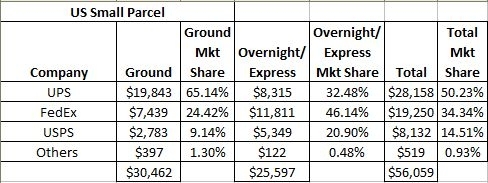

U.s. Small Parcel

The US small-scale parcel industry is composed, near entirely, by UPS, FedEx, and the U.s. Post (USPS). In the not too afar past, UPS had an extraordinary market share of around 80%. This has been slowly eroded by first, the introduction of overnight aircraft and 2d, the launch of RPS and its successor FedEx Ground.

It makes a great deal of sense for the other two international players (DHL and TNT) to build a United States network. Indeed, DHL has recently tried and failed. It takes a tremendous corporeality of capital and patience to successfully lauch a package network over an area as vast as the United States and since DHL could either not find a style to properly operate or did non have the patience to see its investment through, it is not probable that new threats would emerge to the current market structure. This volition be further discussed later. On the other hand the current duopoly should not be too conceited about their domicile market, RPS' success proves it tin can exist done and the coexistence of more two carriers internationally leads one to believe that the market place could absorb boosted competition.

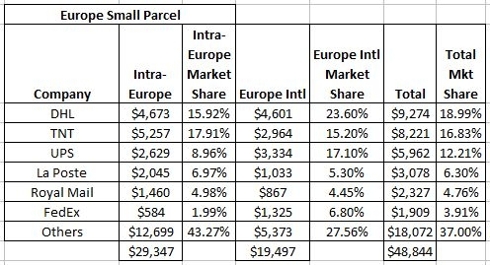

Europe Modest Parcel

The European market construction owes itself to postal services that no longer agree monopolies on mail deliveries in their native countries. Merely as information technology is extremely hard for foreign companies to launch Us services, information technology is extremely difficult for American companies to exercise the same in Europe. FedEx tried and gave upward, its business in Europe is limited to export business, with the small amount of intra-Europe revenue it has being from deliveries between European countries.

Information technology was no easier for UPS. West Frg was its first foray internationally forth with Canada. Numerous cultural barriers had to be overcome followed by continued investment to slowly build the scale necessary to compete. Many within the company thought information technology was a mistake and that UPS should carelessness Europe. It appears that the largest factor in the eventual success was the partner like nature of the company. At the time only current and former employees endemic the outstanding stock. Had UPS been a publicly traded company as it is now and every bit FedEx and DHL are, it is not clear that Europe would non have been abased. As it slowly gained traction, UPS has gear up an integrated air and ground network similar to that which exists in the The states.

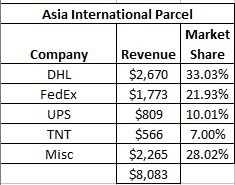

Asian Small Bundle

Asia is an entirely dissimilar surroundings, if but considering of geography. It is incommunicable to fix large integrated ground companies because many of the important markets are divided past oceans. The only way to successfully operate is to have a dedicated air fleet. For this reason, FedEx clearly is more comfortable than UPS operating in the region and they were too the first to make it a priority by sensing the huge inherit demand of Asia-Pacific shipping. They are currently about twice as large every bit UPS in the region. DHL in Asia is roughly as large as FedEx and UPS combined, and thus has the strongest position. The figures below are for exports just and do not include shipping between Asian countries.

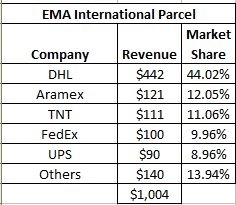

Eastern Europe, the Eye East, and Africa Small Parcel

DHL conspicuously has the upper hand in this part of the world. Information technology is likely to remain this way as competitors view other parts of the earth as more strategic and worthy of the bulk of available investment funds.

North and South America (except the Us) Small Packet

FedEx has the advantage here, and UPS and FedEx predictably dominate. It is probable that South America will increasingly become a battle footing if Brazil continues its recent economical performance.

Consolidated Global Small Parcel

The higher up title is something of a misnomer since I have already confessed to the fact that the previous figures are not exhaustive. The available figures when added together are also extremely full-bodied in the United States and Europe, while these are the ii largest small parcel markets they are non as big relative to the rest of the earth when export volume is all that is considered in many markets. Despite its limitations, the consolidated figures do provide a good measure of the global market place and also accurately illustrate the authority of UPS, FedEx, DHL, and TNT.

I have too added a column that weights each market share past the regions contribution to world GDP. This approach has its limitations every bit well, but gives a greater weight to emerging regions where transportation has not all the same reached the penetration relative to the overall economy that mature economies accept. The weights used were based upon GDP figures from the CIA World Factbook and are 24.52% for the United states of america, 27.62% for Europe, 28.17% for Asia, 8.v% for Eastern Europe, the Middle Due east, and Africa, and eleven.18% for the Americas.

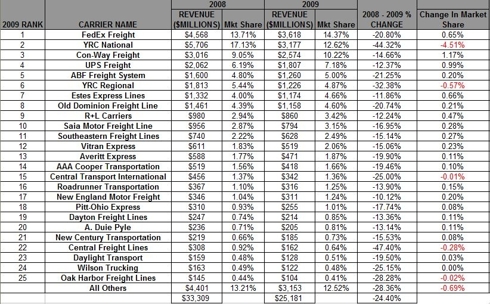

North American Less-Than-Truckload (LTL) Freight

The LTL marketplace provides far less favorable economics than the small parcel market, primarily because of greater competition. FedEx seems to have viewed LTL more positively than UPS has. Information technology also has 2 separate LTL networks: a regional network built from Viking in the west and American Freightways in the east and a national network from the acquisition of Watkins Motor Lines. It has recently announced the integration of those two networks. That will certainly present some challenges (more so than many have indicated) but will also instill greater discipline to the market place.

UPS entered the industry with its purchase of Overnite. Many of UPS' past acquisitions have been made in part as a means to move more packages through its minor parcel network (such equally customs brokerage acquisitions and The UPS Shop). Entry into the LTL market seems to exist for the opposite reasons. Using LTL contacts to gain small parcel volume has not been as meaningful as using small parcel contacts to gain LTL market place share. Technology, in which UPS and FedEx have massive advantages over other freight providers, has also been transferred to LTL.

The industry overall appears to be more rational than information technology has historically been, despite weak industry conditions at nowadays. It does not seem probable that much capacity volition be added in aggregate any time soon. Indeed, the largest player YRC Worldwide has shed chapters in its network integration of Yellow and Roadway. And equally already mentioned, FedEx is likewise shedding capacity. The industry volition never have the profitability that small parcel shipping does, just once industry atmospheric condition are more than normalized information technology is likely that plenty of profits will go around. The biggest threat to trucking is runway, specially if fuel prices spike once again. In all likelihood, carriers will continue to attempt to transport freight that is non time sensitive and over long distances through railroads. As I already mentioned, the market share information below comes from SJ Consulting, which is far and away the all-time source for industry data.

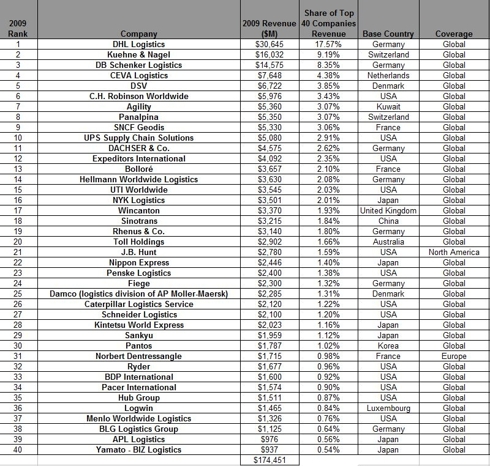

Logistics

This is an area in which UPS has a large presence and FedEx does not. Much like FedEx appears to be much more optimistic nigh the LTL industry, UPS appears to exist much more than optimistic almost nugget calorie-free transportation businesses.

One of the selling points made past UPS is that it can be the entire supply chain, analogous and tracking everything from supplier shipments to electric current inventory levels to final delivery to the customer. This is especially appealing to pocket-sized businesses who have more to proceeds from UPS' scale and applied science than larger businesses would, simply big corporations also rent UPS to oversee portions of their supply chain. In particular UPS has focused on three core areas: retail, technology, and health care.

In addition to these, UPS logistics' businesses include freight forwarding and customs brokerage. FedEx is too a player in those businesses, but they have so far limited themselves to asset light companies that take clear synergies with their asset based networks (such equally customs brokerage).

The beneath figures are global and are taken from figures compiled by SJ Consulting.

Retail

Both UPS and FedEx take purchased retail presences in order to boost services to pocket-size businesses and create boosted volume opportunities. UPS purchased Mail Boxes, etc. in 2001 for $185 one thousand thousand in cash. Sometime subsequently, at the outset of 2004, FedEx airtight its acquisition of Kinko's which toll $ii.2 billion in cash along with the supposition of almost $200 million in debt. Both companies have been re-branded to The UPS Store and FedEx Role in the time since. It is also safe to say that each company had difficulties with these acquisitions.

A package network has substantial fixed costs and as a issue must secure a minimum level of book to be profitable. Every bit a result, a large proportion of volume for both UPS and FedEx are securely discounted shipments originating with businesses. These discounts are not given in the retail market, because the volume per shipper is so small. Equally a result this retail volume carries bonny margins.

The UPS Store inherited a franchise model from Post Boxes, etc. This allowed for rapid expansion while maintaining below average capital requirements. But following UPS' purchase information technology became clear that oft the interests of the parent and subsidiary might frequently diverge. The goal in purchasing the company was clearly to secure a stable ways of generating volume through the so 3,300 US franchises. The problem, though, was that UPS had an incentive to encourage volume growth through channels other than retail since it is more efficient to take a driver just make a daily pick up than to insert a retail relationship betwixt UPS and the client. The relationship between UPS and franchisees has been acrimonious to say the least and the issues remain unresolved. Prior to UPS, Mail Boxes, etc. was owned by US Office Products Company, which is now broke, but based upon its filings Postal service Boxes, etc. had operating margins typically close to the mid to loftier teens and acquirement was close to $85 million at the time UPS purchased the company. So UPS, past my estimate, paid around 22 times earnings for the company. Of course, as has already been laid out, it was for book and non earnings that the visitor was purchased and thus the electric current poor relationship with the franchisees. Since there were 3,300 locations in the United States when UPS bought the company and that number remains the same today, it appears that expansion has non been a priority.

Kinko's was founded in 1970 and for a long fourth dimension geared itself towards college students rather than business organization professionals or small business owners. The stores are non franchised, which means a higher internet investment from FedEx, but control over corporate strategy without having to interact with franchise owners. A typical Kinko'southward besides has a more various revenue stream including printing services and function supplies. Equally a result, each location does substantially more acquirement than a UPS Shop would, merely the store footprint is smaller. At the fourth dimension of purchase there were about 1,300 US and Canadian Kinko's locations and today there are 1,800. Based upon a $2.two billion cash price, revenues of near $2 billion, and an operating margin of 7% FedEx paid nigh 24 times earnings for Kinko's.

The Future

"It is best to read the atmospheric condition forecast before praying for rain." – Marker Twain

Perhaps the most important question for both UPS and FedEx is whether or not the small package oligopoly in the United States continues. The simple answer is that it is very likely that it will. This does non make very expert economic sense since over the course of an economic cycle the existing carriers earn substantially more than their price of majuscule. Why is it that this has not and volition not attract competition? Looking at the global market place it would seem probable that both DHL and TNT would eventually brand a move to capture a share of the Usa market. Of course, DHL did enter the market and failed. Why? DHL's feel is central to understanding the time to come of small packet shipping in the United States.

DHL had deep pockets to fund its move into the US market. Information technology paid $1.05 billion for Airborne Express in 2003 and so invested, along with Airborne, a further $1.ix billion. To summit it off was a $150 million marketing campaign. Shippers also had an incentive to see the market become competitive and were willing to give the start upward the do good of the doubtfulness. Many states gave DHL some or all of their overnight business while companies like Dell and Skechers too shifted some of their shipments. Since capacity was tight between 2003 and 2007, UPS and FedEx did not initiate a price state of war with DHL either. In brusque, the timing was near perfect for a new entrant.

The failure of DHL in this context can seem puzzling. The reality was that they put the cart before the horse by seeking to secure business while operations were not fully in place. If DHL had first worked through common operational challenges so gradually brought on new business organisation, they may notwithstanding exist in the Us. Once a reputation is gained for unreliability, though, it is very difficult to alter, much like Hester Prynne'due south cherry-red letter. Other challenges existed as well, such as the relationship with Airborne. Whatever your view of the lessons from DHL'south results are three facts seem undeniable: DHL was the most probable visitor to exist the tertiary Usa pocket-size parcel provider, the time selected by DHL was a good i with by and large tight chapters, and DHL could non gain traction. In view of this information technology seems improbable, though not certain, that new competition will sally anytime soon.

That leads to the adjacent logical question: If the market will exist carved up between UPS and FedEx how will information technology be shared? First, it is of import to revisit the ii business concern models in the U.s.a.. UPS has integrated operations for both air and ground commitment (the line haul operations are necessarily independent) while FedEx has distinct air and ground networks. Option-upward and delivery drivers for FedEx are independent contractors, similar to franchise owners. They own their own trucks, pay for their own fuel, and are paid by the packet. UPS drivers are unionized employees paid by the hour. It seems straightforward to me to say that the integrated model of UPS is intrinsically more than efficient since then much of transportation efficiency is based upon density. At the same time, the FedEx model places more responsibleness on the shoulders of drivers to be productive and ultimately a greater share of the profit pool accrues to the owners rather than to labor. I am non taking sides in the morality of either model or in any way implying that UPS drivers are not productive (the verbal opposite is the truth). What I am doing is stating some straightforward truths based upon history. Many of the estimates I have seen place the straight costs of FedEx operating both networks every bit about fifteen% less per package than UPS operating one network. Based upon that it may be surprising to view the post-obit information for US small parcel operating margins; UPS for its integrated network and FedEx for ground only.

Why has UPS been more profitable? Because many of the costs incurred have been fixed or of a fixed like nature. These include technology and supervision, where more volume tin can blot these costs. Here are the ground revenues for both companies over the same time frame.

UPS should be concerned about the trends. If FedEx continues to make volume gains along with maintaining a straight cost advantage, they could in time seize dominance in the industry.

In that location are other factors that are a concern for FedEx. These are mostly legal and political. On the legal front, many have challenged the independent contractor model in court, challenge that they legally should be classified equally employees. Many of the issues accept come in Massachusetts and California. If FedEx loses these battles it seems likely that unionization would follow. And then the future of the statement should correctly be placed in the context of labor's part in the economy. If the ability of unions persist at current levels, it seems unlikely that this model will be upended. On the other hand if the events of the by few years signify a long term pivot in the distribution of political power then there is a reasonable hazard that serious challenges could mountain, both in the laws preventing FedEx Limited from unionizing and the model which prevents FedEx Basis from doing so.

Regardless, the US market will continue to have plenty of volume to decorated both carriers fifty-fifty every bit the nature of competitive reward could shift dramatically.

Valuation

Because of the cyclical nature of the underlying businesses I chose to value them using a sum of the parts analysis and assume that volume and margins render to the historical peak of 2007.

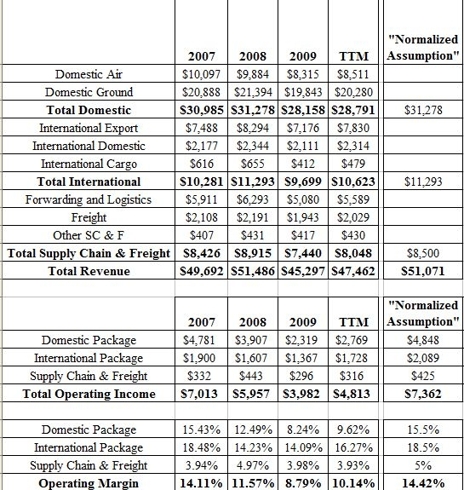

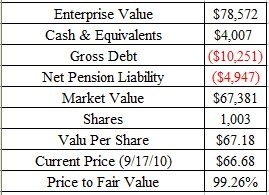

Commencement, here are the valuation assumptions for UPS which should hopefully exist very straightforward.

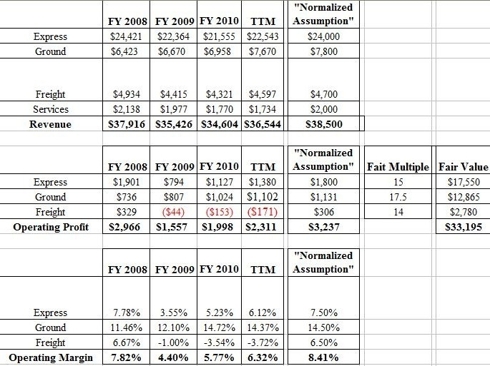

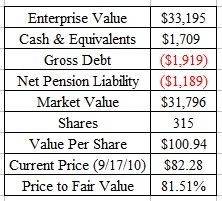

Here is the similar chart for FedEx.

To put the higher up results into perspective, they assume that normalized earnings for UPS are $4.77 per share and a fair multiple is 15. Normalized earnings for FedEx are assumed to be about $6.68 and a fair multiple is besides about xv. In the case of UPS, returns on investment are still greater but so are the gross amount of debt and pension liabilities.

Your valuation model or estimates would probable be different than mine, simply the valuations do not need to exist complicated. FedEx is statistically cheaper, simply I would challenge you lot to answer the following questions before making whatever valuation or investing decisions:

one. What is the likelihood another aspirant will enter the U.s.a. small-scale parcel market?

2. What role volition labor accept in political soapbox ten years from now?

3. Volition growth in emerging markets continue and what function will Us multinationals play in that growth?

iv. Do you think that at that place is some probability globalization could reverse itself?

I have my own answers which are very low, as well hard to say, probably and a lot, and yes but it is non very loftier.

To conclude, consider what John Maynard Keynes wrote after the first World War apropos the era of globalization he lived through in his book The Economical Consequences of the Peace published in 1920:

The inhabitant of London could order by phone, sipping his morning time tea in bed, the diverse products of the whole earth, in such quantity equally he might see fit, and reasonably expect their early delivery upon his door-step; he could at the same moment and by the same means gamble his wealth in the natural resources and new enterprises of any quarter of the globe, and share, without exertion or fifty-fifty problem, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of whatever substantial municipality in any continent that fancy or information might recommend. He could secure forthwith, if he wished it, inexpensive and comfy means of transit to any state or climate without passport or other formality, could acceleration his servant to the neighboring office of a bank for such supply of the precious metals as might seem convenient, and could then proceed abroad to foreign quarters, without knowledge of their organized religion, language, or customs, bearing coined wealth upon his person, and would consider himself greatly aggrieved and much surprised at the least interference. But, most important of all, he regarded this state of affairs every bit normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable. The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions, and exclusion, which were to play the snake to this paradise, were fiddling more than the amusements of his daily newspaper, and appeared to practice virtually no influence at all on the ordinary course of social and economic life, the internationalization of which was nearly complete in do.

Information technology is likely that today's trends, whatever they may be, will survive through tomorrow. But since they may not a margin of safe is e'er demanded. No one is going to out smart the world with excel spreadsheets; to make intelligent investing decisions, one must intelligently handicap outcomes. Although nosotros enjoy huge advantages over those living one hundred years ago ane fact remains constant: the world is an uncertain identify.

Disclosure: The author owns shares of UPS (UPS) and has no interest in FedEx (FDX).

This article was written past

Ohio Capital Ideas is a individual investor, investment analyst, and writer from Ohio. My interest in investing was first sparked by watching the tech bubble of the late 1990s and the attitude of the time that successful investing was easy. Feel has shown that investing is far from easy. Since then, I have spent a significant corporeality of time growing my noesis of successful investing, reading almost other successful investors, and managing my own family'south investments. The process of writing, too equally respectfully debating points of view through comments and messages with others, is a nifty aid to the investment process. My writing tin can be divided into three categories, which I list below along with what I believe to be the best examples in each category to read if you are new to my writing. • In-depth research on specific companies, the vast majority of which are long ideas, but which volition occasionally include a short thesis.Bollore's Shares Are Cheap, But Value Nevertheless Mostly Rests On Unwinding Complex StructureInvestors Title Looks Attractive Once again Despite Non Being The Bargain It In one case WasPlaying With Guns: Is There A Betoken Of Saturation?• Occasional commentary on economic topics such as the business bicycle, fiscal and monetary concerns, or secular economical shifts.A Corking Big Beautiful Tomorrow: Examining The Slowdowns In Investment And ProductivitySeparating The Wheat From The Crust• Capital Interviews: Interviews of authors, portfolio managers, or CEO's.Capital Interviews: Lawrence Cunningham Discusses The Art And Value Of The Shareholder LetterCapital Interviews: Steven Wood of GreenWood Investors Discusses His Investment Process And How To Identify BuildersCapital Interviews: Gerald Posner Discusses His New Book On Pharma, The Pandemic, And The Future Of The IndustryThe proper name "Ohio Uppercase Ideas" comes from the book Uppercase Ideas by Peter Bernstein. For a period of time I wrote nether the name "Majuscule Ideas", but added the "Ohio" to distinguish between other commentators and newsletters using the generic term "Capital letter Ideas" and avert any possibility of confusion. You can find additional writings from me at Talk Markets.Feel free to contact me regarding my inquiry either via the platform or at ohiocapitalideas at gmail.com. Ohio Capital Ideas is non a registered investment counselor, legal or taxation advisor, or a banker / dealer. All opinions expressed are from personal inquiry and intended to be educational. Yous should consider your own personal situation and seek tailored professional communication if needed earlier making any investing or financial decisions for yourself. "Two types of choices seem to me to have been crucial in tipping the outcomes towards success or failure: long-term planning and willingness to reconsider core values. On reflection we can also recognize the crucial role of these aforementioned two choices for the outcomes of our individual lives." -Jared Diamond

Source: https://seekingalpha.com/article/225976-the-small-parcel-oligopoly

Posted by: johnsonrappe1996.blogspot.com

0 Response to "Is Courier Parcel Service A Natural Monopoly Or Oligopoly?"

Post a Comment